Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

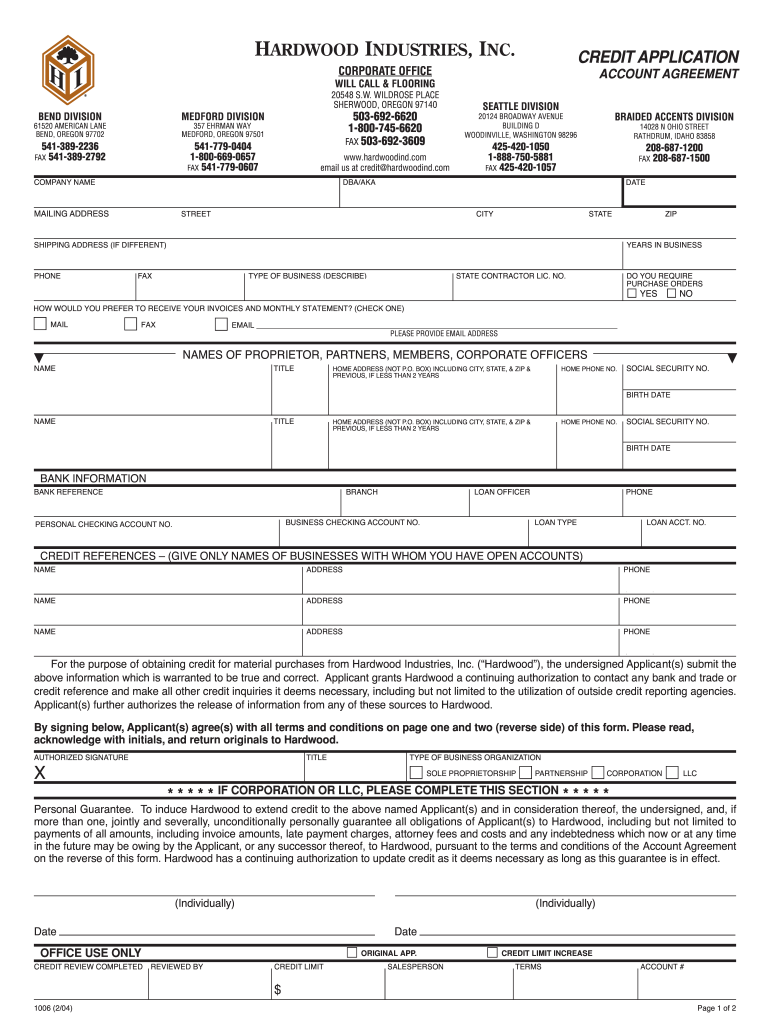

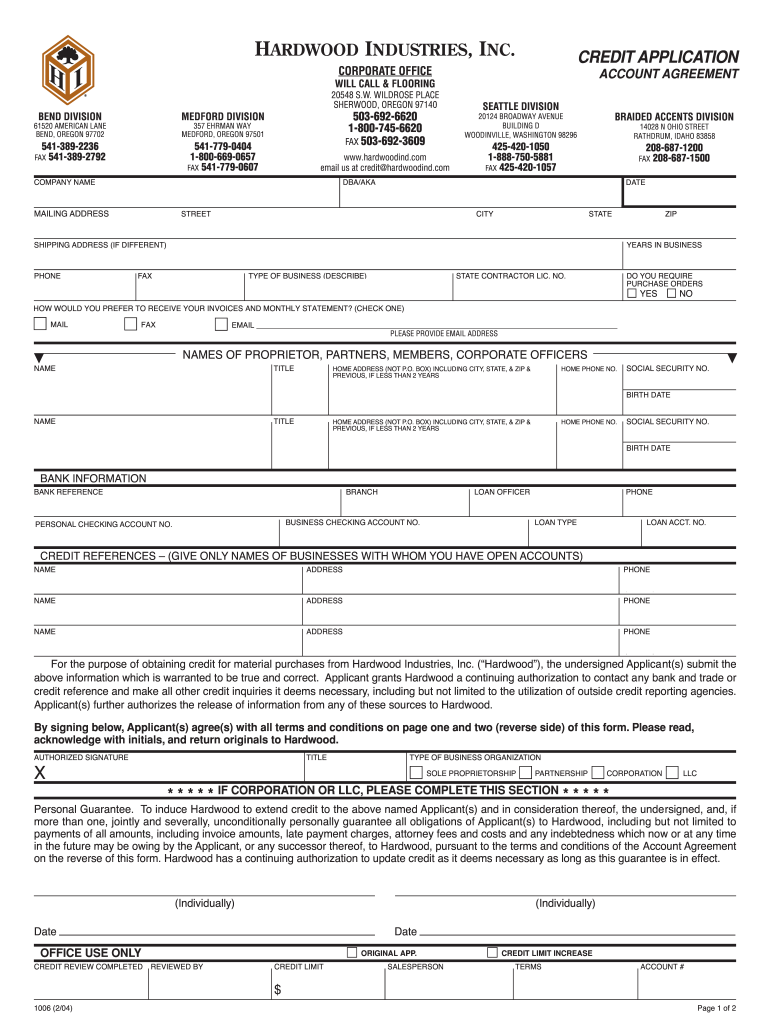

What is credit application form?

A credit application form is a document used by a business to assess an individual or business’s creditworthiness. The form typically requires the applicant to provide information such as their name, address, income, credit history, and other financial information for evaluation. The form is used to determine if an applicant will be approved for a loan or line of credit.

Who is required to file credit application form?

Any individual or business that is seeking a loan or a line of credit from a financial institution is typically required to fill out a credit application form. The form is used by lenders to assess the creditworthiness of the applicant.

What is the purpose of credit application form?

A credit application form is used to assess the creditworthiness of potential customers and their ability to repay a loan or other type of debt. The form allows a lender to review the applicant's financial information, such as income, debts, and credit history, and make an informed decision about whether to approve the loan.

What information must be reported on credit application form?

1. Applicant's full name

2. Current address

3. Date of birth

4. Social Security number

5. Income information

6. Employment details

7. Bank account information

8. Identification details

9. Other debt obligations

10. Consent to a credit check

How to fill out credit application form?

Filling out a credit application form is a straightforward process. Here's a step-by-step guide to help you through it:

1. Gather necessary documents: Collect the required documents, such as your identification proof (e.g., driver's license or passport), Social Security Number, employment information, and financial details.

2. Read the form carefully: Read all instructions and fields on the credit application form before you start filling it out. Understand the terms and conditions mentioned, as well as any specific requirements.

3. Personal information: Begin by providing your personal information accurately. This typically includes your full name, current address, date of birth, contact details, and your Social Security Number or a corresponding identification number.

4. Employment details: Provide information about your current and previous employment, including your employer's name, address, and contact information. Also, mention your job title, annual income, and the length of employment.

5. Financial information: Fill in details about your financial situation. This usually includes your monthly income, any other sources of income, monthly expenses, existing debts or liabilities, and bank account information.

6. References: Many credit applications require references. Provide the names, contact details, and relationship of two or three references who are not family members. These may be individuals who can vouch for your character or provide information about your financial stability.

7. Review and proofread: Once you have completed the form, review it carefully. Double-check all the information to ensure accuracy. Any errors or incomplete entries could delay the approval process or result in a rejection.

8. Sign and date: Sign and date the credit application in the designated section to verify that all the information provided is accurate and complete. This signature indicates your consent to the terms and conditions set forth in the application.

9. Attach supporting documents: Check if any additional documents are required to accompany the credit application. These may include proof of income, bank statements, or identification proof. Ensure that you attach these documents securely to the application form.

10. Submitting the application: Submit the completed credit application and any supporting documents to the appropriate authority. This can be done in person at a financial institution or by mailing the application to the provided address. Alternatively, some companies may allow you to submit the application online through their website.

Remember to keep a copy of the completed credit application and all supporting documents for your records.

What is the penalty for the late filing of credit application form?

The penalty for late filing of a credit application form can vary depending on the specific circumstances and the institution or organization involved. In general, the consequence of late filing can include the following:

1. Delayed processing: Late submission of a credit application form can result in a delay in the processing of your application. This could potentially extend the time it takes to obtain credit approval or funds.

2. Negative impact on credit score: Credit bureaus may take note of late filings and could potentially lower your credit score. This can have a long-term impact on your ability to secure credit in the future.

3. Loss of opportunity: If the credit application form has a deadline or is tied to a specific offer or promotion, submitting it late may result in missing out on that opportunity.

4. Late fees or penalties: Some lenders or credit institutions may impose late fees or penalties for overdue applications. These charges can vary in amount and may be stipulated in the terms and conditions of the application or agreement.

It is advisable to always submit credit application forms on time to avoid any potential negative consequences. If you anticipate a delay, it is best to communicate with the relevant institution or lender in advance to discuss possible accommodations or extensions.

How can I modify fillable credit application form without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your fillable credit application form into a dynamic fillable form that you can manage and eSign from anywhere.

How do I make edits in fillable credit form without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing fillable credit and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How can I edit fillable credit application printable on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing fillable credit application blank form, you need to install and log in to the app.